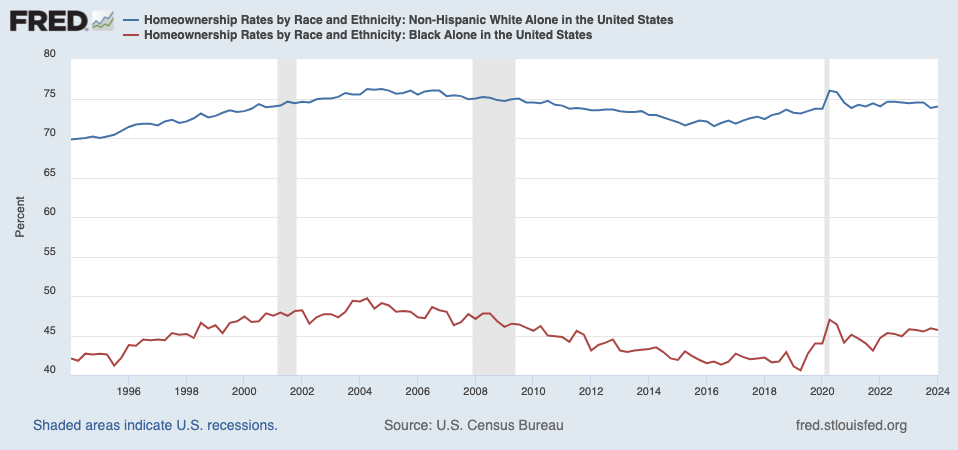

Homeownership and Wealth Disparities-- By KaylieChen - 23 Feb 2024 Affordable housing has been a longstanding concern across the United States. However, these housing conversations often overlook the critical importance of homeownership. A study conducted by the United States Department of Housing and Urban Development revealed that homeownership was an important means of wealth accumulation and was particularly important for minority and lower-income households. Despite this finding, Black, Indigenous, and other People of Color (BIPOC)—particularly Black communities—consistently have lower rates of homeownership when compared to their white counterparts. This is largely a result of past federal policies that systematically excluded these populations from homeownership. Through research, advocacy, and effective implementation of policies designed to promote housing affordability and eliminate discriminatory barriers, this housing inequality can begin to be addressed, and in turn, the racial wealth gap.Past Federal PoliciesIn his book The Color of Law: A Forgotten History of How Our Government Segregated America, Richard Rothstein highlights how the Federal Housing Administration (FHA) played a significant role in the low rates of BIPOC homeownership by refusing to insure mortgages for Black people and redlining their communities as too risky for loans. The FHA additionally subsidized the mass production of subdivisions with the stipulation that no homes be sold to Black people. These actions prevented Black people from purchasing homes at the same rate as white people, thereby creating and perpetuating racial disparities in homeownership. This practice stifled lending and investment, depressed property values, and significantly hindered economic growth in BIPOC communities. State and local governments, banks, and private developers compounded the problem with their own discriminatory practices, confining BIPOC to substandard housing and limiting their homeownership opportunities. Despite being illegal today, the legacy of these policies persists, and discrimination in housing has never fully disappeared. Figure 1: FRED graph depicting the United States homeownership rates of Non-Hispanic White and Black communities from 1994 to 2024.

Figure 1: FRED graph depicting the United States homeownership rates of Non-Hispanic White and Black communities from 1994 to 2024.

How Homeownership Leads to Wealth AccumulationThomas Shapiro, author of Race, Homeownership and Wealth, found that home wealth accounts for 60% of the total wealth among America’s middle class, indicating that homeownership and housing appreciation are the foundation of institutional accumulation. This can be attributed to several causes. According to an article by the Urban Institute, homeownership helps borrowers accumulate both housing and nonhousing wealth with tax advantages, greater financial flexibility due to secured borrowing, and built-in “default” savings with mortgage amortization and nominally fixed payments. Because BIPOC were unable to purchase homes during the crucial time in the mid-1900s, they have been unable to accrue wealth at a similar rate as their white counterparts. Even if BIPOC families purchase homes now, their homes do not grow in value as fast as whites' homes do. Homebuyers look for amenities like parks and “good schools” which are commonly found in predominantly white neighborhoods. Because of this, housing segregation can and has cost Black people tens of thousands of dollars in home equity. This inability to generate wealth causes a myriad of other problems for BIPOC, like being unable to access certain educational opportunities. For public schools, a large portion of school revenue is derived from local property taxes. As a result, the schools BIPOC can attend generally have less funding and resources than whiter, more affluent schools. Moreover, research has shown that as the average family income in a school goes up, so too does student achievement, while schools with lower average family incomes generally feature slower learning curves. Quality of education can detrimentally impact one’s future and ability to be employed at a high-paying job. And, if one does not have enough money to purchase a house in a “better neighborhood,” this cycle may continue for future generations.What Can Be DoneAddressing the housing affordability crisis in New York and other high-cost regions requires a multifaceted approach. Conducting research is essential to understanding the problem and exploring potential solutions. This research then allows for the education of the public and policymakers about the systemic issues contributing to the racial wealth gap and the need for targeted interventions to address these disparities. Educating the public allows impacted communities to understand their rights and the resources available to them. Grassroots organizing can also amplify the voices of those most affected by housing disparities, ensuring that their needs and perspectives are central to policy discussions. In addition to community engagement, advocacy at all levels of government is crucial in establishing policies that promote housing production and affordability while eliminating discriminatory barriers. Policymakers must first be informed about the importance of inclusive housing practices to be willing to prioritize the needs of marginalized communities. This includes supporting policies that promote economic and racial justice, even in the face of opposition from well-financed groups. Leadership that is committed to equity can drive significant change and help dismantle the systemic barriers that have perpetuated the racial wealth gap. Advocacy efforts should further extend to financial institutions to improve lending practices, ensuring that communities of color have better access to mortgages and homeownership opportunities. Effective implementation of legislation and regulations is necessary to make a real-world difference. However, it is important to remember that passing good laws is not enough; they must be enforced in a way that genuinely boosts economic security and access to housing. This requires vigilance and accountability to ensure that policies are not merely symbolic but result in actual, tangible improvements. Creating a reality in which owning a home is attainable for these historically marginalized communities requires addressing the historical and ongoing injustices they face. A comprehensive approach that includes research, education, advocacy, innovative solutions, political courage, and community engagement is necessary to fulfill this vision. Through collective efforts, a more equitable society in which any resident can own a home and build wealth can slowly begin to form.You are entitled to restrict access to your paper if you want to. But we all derive immense benefit from reading one another's work, and I hope you won't feel the need unless the subject matter is personal and its disclosure would be harmful or undesirable. To restrict access to your paper simply delete the "#" character on the next two lines:

|

|